Unlocking the secrets behind economic growth, this article delves into the calculation of MPC, MPS, and the multiplier. Like puzzle pieces forming a cohesive picture, understanding these concepts can illuminate the intricate workings of an economy. By examining real-life examples and dissecting the factors influencing MPC, readers will gain valuable insights into the multiplier effect. With concise analysis and data-driven explanations, this article invites readers to embark on a journey towards a deeper comprehension of these essential economic calculations.

Key Takeaways

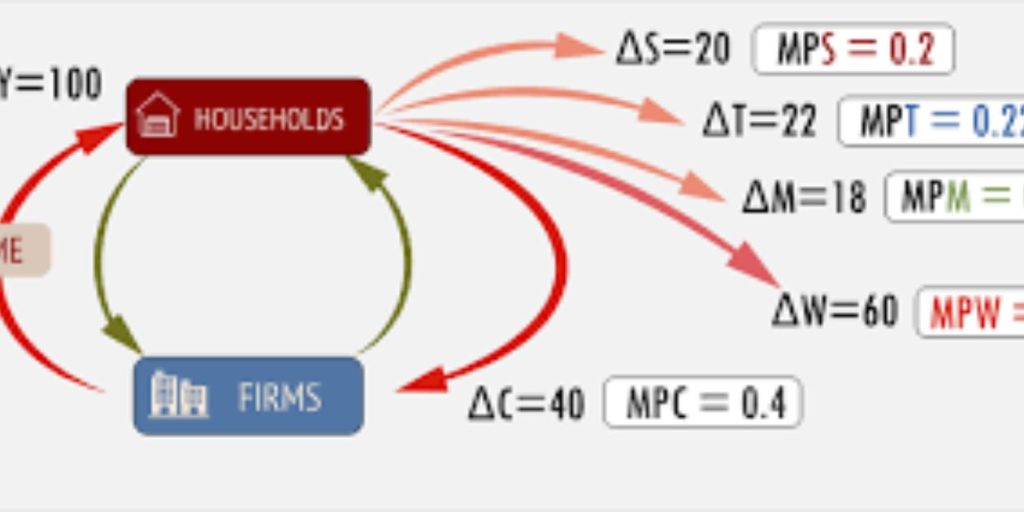

• MPC refers to the proportion of additional income spent on consumption, while MPS calculates the proportion of additional income saved instead of spent.

• MPC and MPS are crucial in calculating the multiplier, which demonstrates the amplification effect of changes in spending on the economy.

• Factors such as income levels, interest rates, consumer confidence, and government policies influence MPC and MPS, thereby impacting the overall economy.

• Understanding the implications of the multiplier effect is essential for economic analysis and policy-making, as changes in spending and saving behaviors can have a significant impact on economic growth.

The Basics of MPC Calculation

In the world of video games, the MPC, much like the delicate balance of nature, embodies the essence of progression. Just as in nature, where every intricate detail is interconnected and flows harmoniously, the MPC calculation within video games represents the proportion of earned rewards or resources that a player invests back into enhancing their virtual journey. Like a gentle breeze shaping the landscape, understanding the MPC allows gamers to grasp the dynamics of resource allocation, guiding their choices and steering the course of their virtual adventures. In order to thrive in these digital realms, it is essential for players to delve into the basics of MPC, just as one must comprehend the fundamental principles of nature to appreciate its unique beauty.

Understanding MPS Calculation

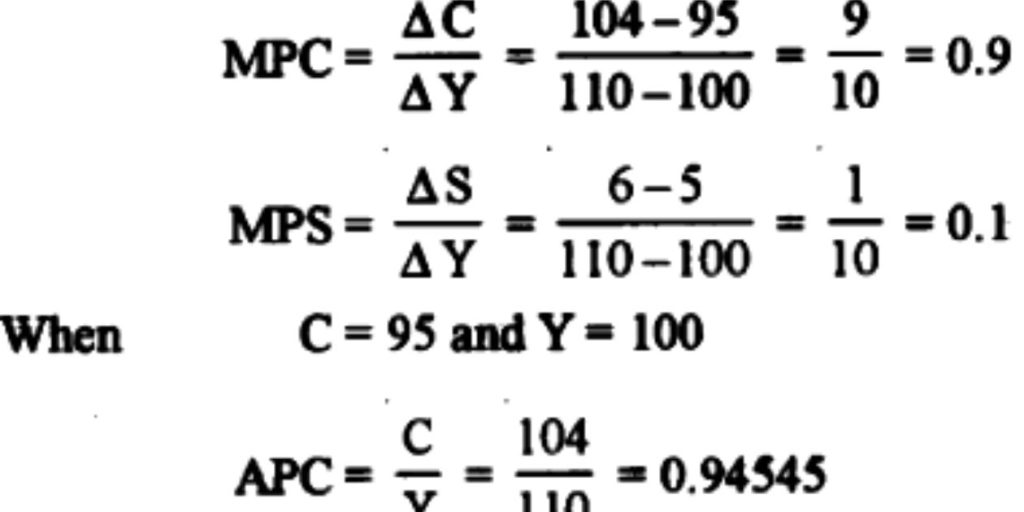

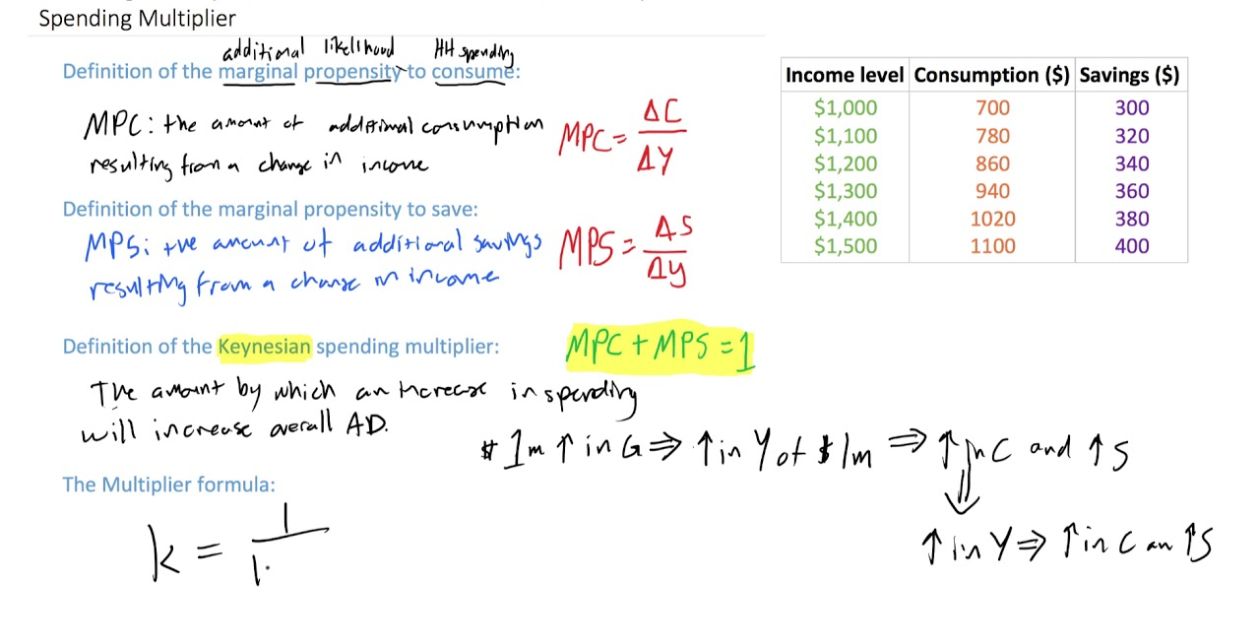

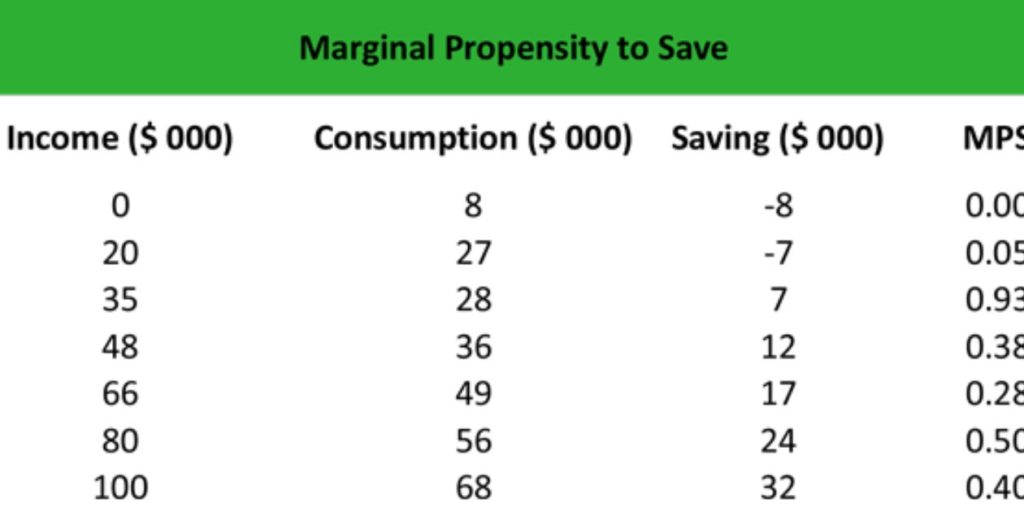

One important aspect of understanding MPS calculation is that it involves the calculation of the marginal propensity to save, or the proportion of additional income that a consumer saves rather than spends. MPS is a crucial component in calculating the multiplier, which measures the impact of changes in spending on the overall economy. To calculate MPS, divide the change in saving by the change in income. This section provides relevant information and contextually explains the calculation of MPS within the broader context of the article.

Exploring the Multiplier Concept

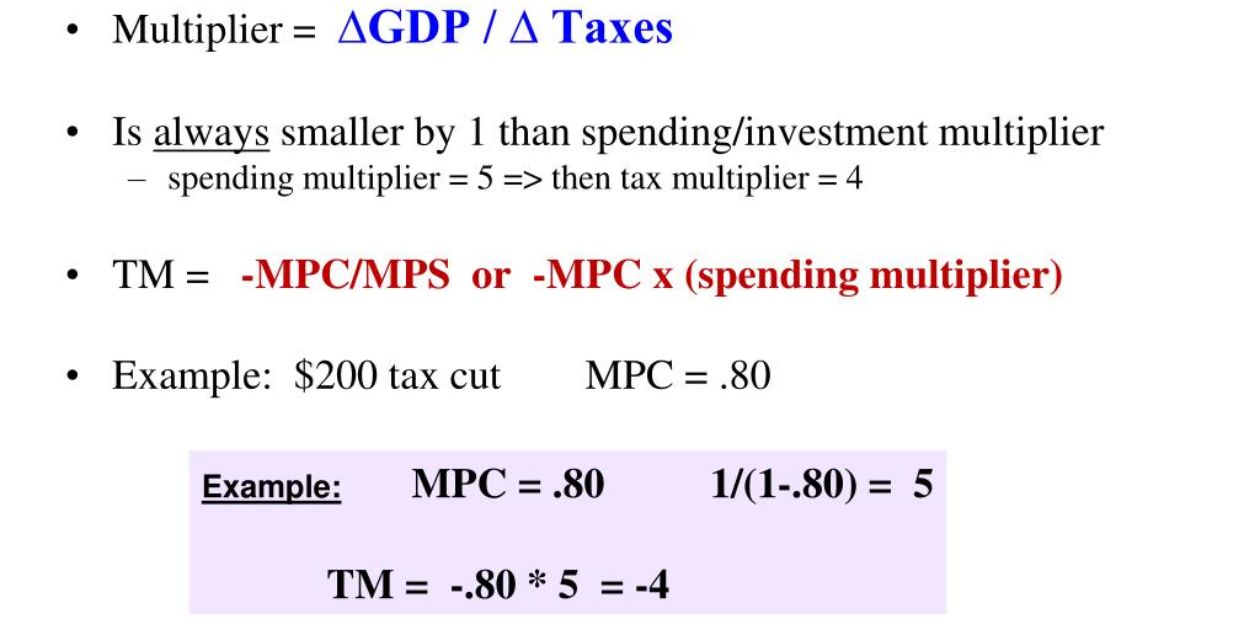

The multiplier concept illustrates the amplification effect that changes in spending have on the overall economy. It is a relevant and contextually important topic in the article section about exploring the multiplier concept. To draw the audience in and keep them interested, here are three key points to consider:

1. Understanding the multiplier concept is crucial for policymakers and economists to calculate the impact of changes in spending on economic growth.

2. The multiplier is calculated by dividing the change in real GDP by the initial change in spending.

3. The multiplier is influenced by the Marginal Propensity to Consume (MPC) and the Marginal Propensity to Save (MPS), which represent the proportion of additional income spent or saved, respectively.

With this understanding of the multiplier concept, we can now delve into the factors that affect the MPC.

Factors Affecting MPC

Factors influencing MPC’s behavior and its impact on the economy can be analyzed through various economic indicators and factors. The MPC, or marginal propensity to consume, represents the proportion of additional income that is spent on consumption. Several factors affect MPC, including income levels, interest rates, consumer confidence, and government policies. Understanding these factors is crucial for policymakers and economists to accurately calculate the multiplier effect and predict the overall impact on the economy. By considering these relevant factors in the context of the article’s section, a comprehensive analysis can be chosen.

Real-life Examples of MPC and MPS Calculation

Several real-life scenarios can illustrate the calculation of MPC and MPS, providing valuable insights into consumer spending and saving patterns. Here are three examples:

1. When consumer spending increases due to an increase in income levels, the MPC can be calculated by dividing the change in consumer spending by the change in income.

2. If the government increases spending, it can lead to additional spending by consumers, resulting in a higher MPC and a positive impact on economic growth.

3. On the other hand, a decrease in consumer spending can be determined by calculating the MPS, which is the proportion of income saved instead of spent. This can have a negative effect on the circular flow of the economy.

Implications of the Multiplier Effect

An important consequence of the multiplier effect is that it amplifies the initial injection of spending into the economy, leading to a significant overall increase in economic output. The multiplier effect can be calculated by using the MPC (marginal propensity to consume) and MPS (marginal propensity to save) values. Understanding the implications of the multiplier effect is crucial in the context of economic policy-making, as it highlights the potential impact of changes in spending and saving behaviors on the overall economy.

Frequently Asked Questions

How Do Changes in Government Spending Affect the Multiplier Effect?

Changes in government spending can have a significant impact on the multiplier effect, amplifying the initial injection of spending through increased consumption and investment. Understanding this relationship is crucial for policymakers in fostering economic growth and stability.

What Are Some Limitations or Drawbacks of Using the MPC and MPS Calculations?

Some limitations of using the MPC and MPS calculations include assumptions of constant values, which may not hold true in reality, and the inability to account for factors such as changes in consumer behavior or government policies.

Can the Multiplier Effect Be Negative? if So, What Does That Indicate?

The multiplier effect can be negative in certain situations. This indicates that an initial decrease in spending or investment leads to a larger decrease in overall economic output, exacerbating economic downturns.

Are There Any Other Factors Besides Disposable Income That Can Affect Consumption and Saving Patterns?

There are several factors, besides disposable income, that can influence consumption and saving patterns. These include interest rates, consumer confidence, government policies, and cultural norms. Understanding these variables is crucial for predicting and analyzing economic behavior.

How Does the Multiplier Effect Impact Economic Growth and Stability in the Long Run?

The multiplier effect has a significant impact on long-term economic growth and stability. It amplifies the initial increase in spending, leading to increased production, employment, and income. This positive cycle contributes to sustained economic expansion and resilience.

Conclusion

In conclusion, understanding the concepts of MPC, MPS, and the multiplier effect is crucial in assessing the impact of changes in income and spending patterns. These calculations provide insights into the dynamics of an economy and help policymakers make informed decisions. By exploring real-life examples and considering various factors affecting MPC, we can gain a deeper understanding of the multiplier effect and its implications. This knowledge empowers us to navigate the complexities of economic systems and create a more prosperous future.

Brook over 3 years of professional gaming, esports coaching, and gaming hardware reviews to provide insightful expertise across PC, console, and mobile gaming.