Discover the hidden power of the multiplier effect and unlock the key to economic growth. In this analytical and data-driven article, we delve into the relationship between the marginal propensity to consume (MPC) and the multiplier. By understanding how to calculate the multiplier from the MPC, we gain valuable insights into the amplification of economic activity. Join us as we explore the factors influencing the size of the multiplier and examine real-world examples that demonstrate its significance. Prepare to embark on a journey of economic discovery and belonging.

Key Takeaways

• MPC represents the portion of additional income spent rather than saved.

• Understanding the relationship between MPC and the multiplier provides insights into the economic impact of consumption behavior.

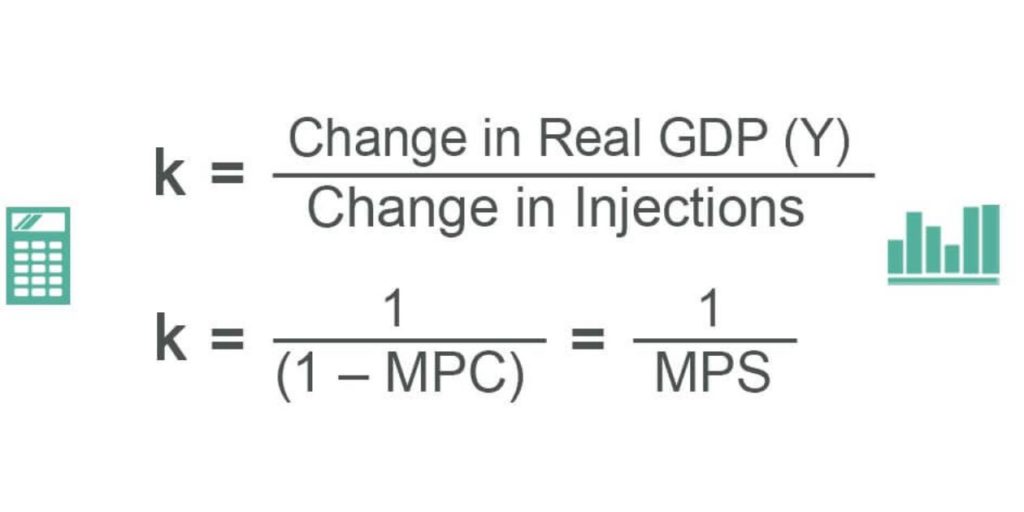

• The multiplier represents the change in output resulting from a change in aggregate demand.

• Factors such as MPC, government spending, and interest rates influence the size of the multiplier.

The Relationship Between MPC and the Multiplier

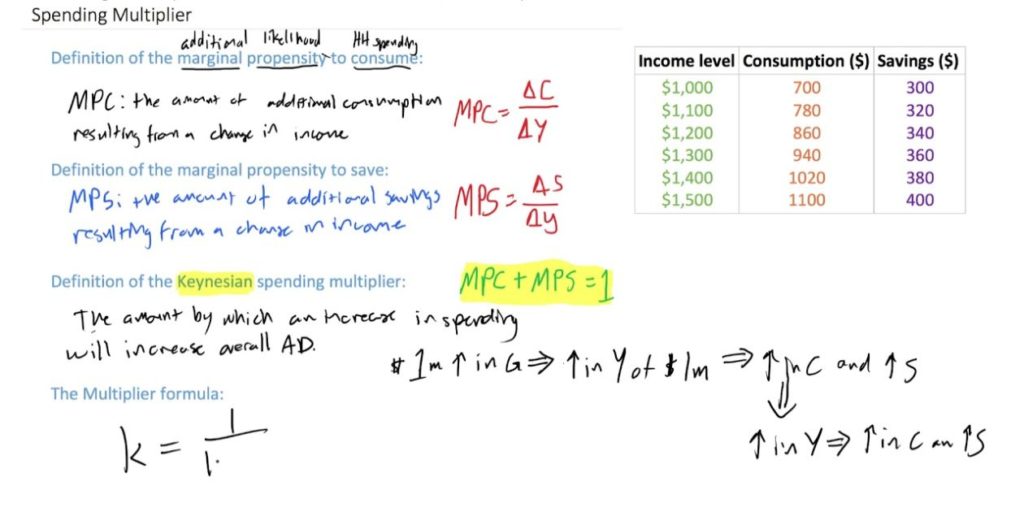

Exploring the correlation between the marginal propensity to consume (MPC) and the spending multiplier, we can gain valuable insights into the economic impact of consumption behavior. The MPC represents the portion of additional income that individuals choose to spend rather than save. By understanding this relationship, we can predict the increase in demand and national income resulting from an increase in income. This data-driven analysis allows us to assess the effects of consumption expenditure on the overall economy.

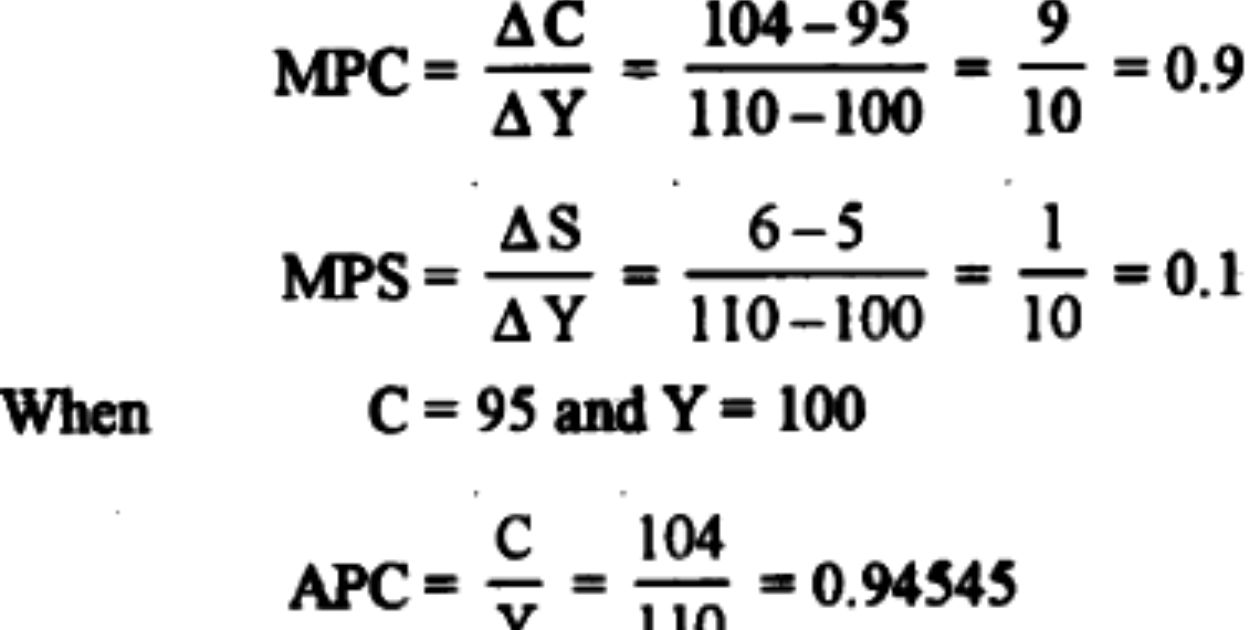

Steps to Calculate the Multiplier From MPC

To calculate the multiplier from the marginal propensity to consume (MPC), there are several steps that need to be followed. First, determine the value of the MPC by dividing the change in consumption by the corresponding change in income. Next, calculate the inverse of the MPC by subtracting the MPC from 1. Finally, use the inverse of the MPC to find the multiplier, which represents the change in output resulting from a change in aggregate demand. Understanding the importance of the multiplier effect will further elucidate the significance of this calculation.

Understanding the Importance of the Multiplier Effect

The multiplier effect is a crucial concept to grasp in order to fully comprehend the significance of this calculation. Understanding the multiplier effect provides contextually relevant insights into the broader economic implications of changes in consumption and investment. It highlights the interconnectedness and interdependence of different sectors within an economy. The multiplier effect also demonstrates how an initial change in spending, captured by the marginal propensity to consume (MPC), can have a magnified impact on overall economic output. In the following section, we will explore the different types of multipliers in economics and their specific applications.

Different Types of Multipliers in Economics

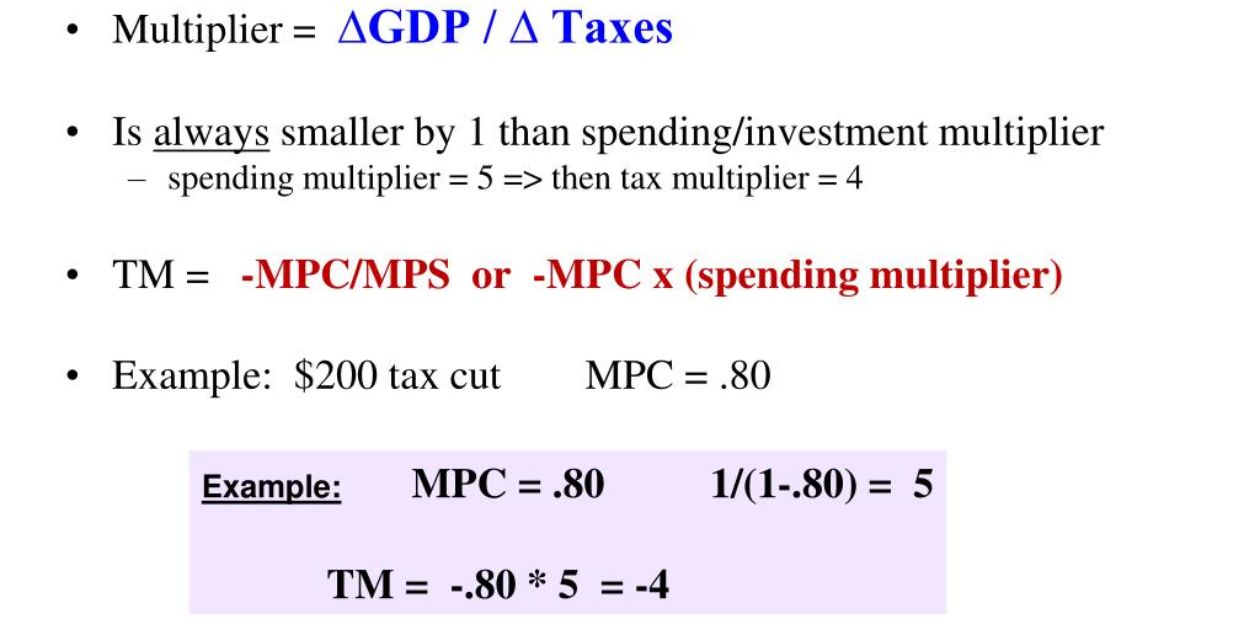

There are several different types of multipliers in economics that play a significant role in understanding the impact of changes in consumption and investment on overall economic output. These multipliers are relevant and contextually important in the field of economics. When analyzing the multiplier effect, economists often choose specific types of multipliers based on the relevant factors being considered. One commonly used multiplier is the MPC (Marginal Propensity to Consume) multiplier, which measures the change in overall output resulting from changes in consumer spending. Other types of multipliers include the investment multiplier and the government spending multiplier. Understanding and utilizing these different types of multipliers is crucial in accurately assessing the impact of various economic factors on overall output.

Factors Influencing the Size of the Multiplier

Factors influencing the size of the multiplier are numerous and complex, requiring a thorough analysis of various economic variables and their interplay. Understanding these factors is crucial for accurately determining the size of the multiplier in a given context. Some key factors that influence the size of the multiplier include:

• Marginal Propensity to Consume (MPC): The higher the MPC, the larger the multiplier effect.

• Government Spending: Increased government spending can lead to a larger multiplier.

• Interest Rates: Lower interest rates can stimulate spending and result in a larger multiplier.

Analyzing these factors and their interrelationships is essential for accurately assessing the size of the multiplier in a specific economic scenario.

Real-World Examples of the Multiplier Effect

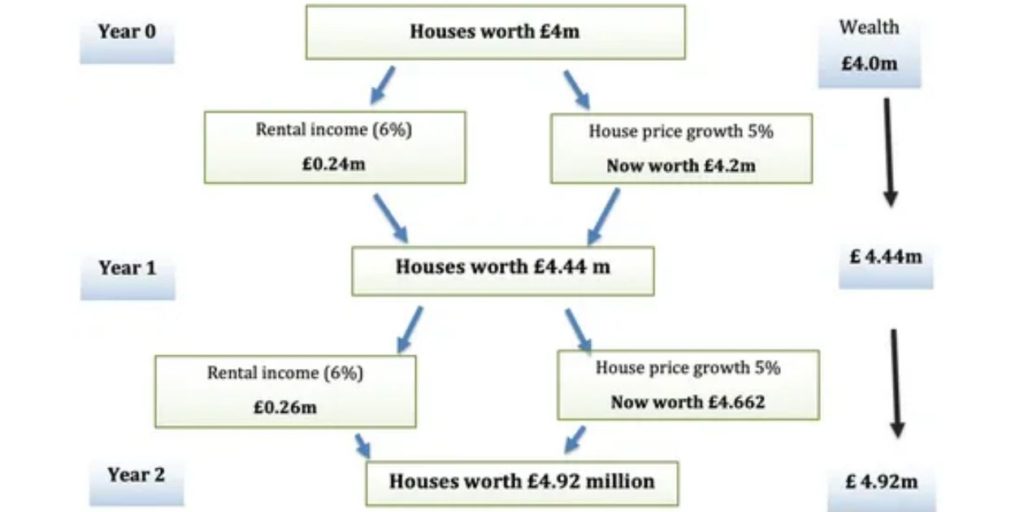

Frequently, real-world examples illustrate the powerful impact of the multiplier effect in various economic scenarios. For instance, during times of economic downturn, governments often implement fiscal policies to stimulate the economy. By increasing government spending, such as on infrastructure projects, the multiplier effect kicks in. This means that the initial injection of funds creates a ripple effect, as the increased spending leads to more income and consumption, thus further boosting economic activity. Understanding the multiplier effect is crucial in formulating effective economic policies.

Frequently Asked Questions

How Does the Multiplier Effect Impact the Overall Economy?

The multiplier effect has a significant impact on the overall economy by magnifying the initial injection of spending. It stimulates economic activity and leads to increased output, employment, and income, contributing to economic growth and stability.

Are There Any Limitations or Drawbacks to Using the Multiplier Effect in Economic Analysis?

Limitations of using the multiplier effect in economic analysis include the assumption of constant marginal propensity to consume (MPC), which may not hold true in reality. Furthermore, it does not account for other factors that influence the economy.

What Are Some Practical Applications of the Multiplier Effect in Real-World Economic Scenarios?

The multiplier effect has practical applications in real-world economic scenarios, such as government spending and investment projects. It helps determine the overall impact on the economy by measuring the change in output resulting from an initial change in spending.

How Does the Size of the Marginal Propensity to Consume (Mpc) Affect the Magnitude of the Multiplier?

The size of the marginal propensity to consume (MPC) directly affects the magnitude of the multiplier. A larger MPC leads to a higher multiplier, indicating a greater impact on overall economic activity.

Can the Multiplier Effect Be Negative, and if So, What Are the Implications of a Negative Multiplier?

The multiplier effect can be negative, which means that a decrease in spending leads to a decrease in economic output. This has implications for economic growth, employment, and overall stability in an economy.

Conclusion

In conclusion, understanding the multiplier effect and how to calculate it from the marginal propensity to consume (MPC) is crucial in economics. By accurately estimating the multiplier, policymakers and economists can assess the impact of changes in consumer spending on overall economic growth. Factors such as the size of the MPC, government spending, and taxation all play a role in determining the size of the multiplier. Real-world examples further demonstrate the significance of the multiplier effect in shaping economic outcomes.

Brook over 3 years of professional gaming, esports coaching, and gaming hardware reviews to provide insightful expertise across PC, console, and mobile gaming.